Gift of Stocks

A tax advantage for you that supports others too

Donating publicly traded securities and mutual funds to Alongside Hope allows you to amplify the impact of your gift so that you can make a big difference in the lives of communities in need around the world.

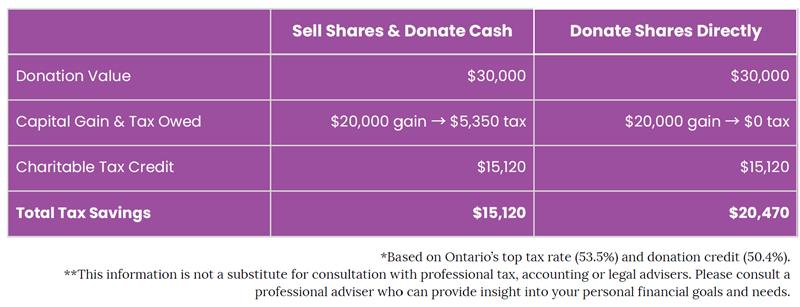

By donating securities you can receive a double tax benefit – you eliminate the capital gains tax you would have to pay if you sold your appreciated securities, and you receive a charitable tax receipt for your donation! Here is an example:

To make a donation of securities please follow the instructions outlined in this Alongside Hope Charitable Gift of Securities Authorization Form.

To learn more about making a Gift of Stocks you can download our information sheet.

The benefits:

- Allows you to amplify the impact of your gift

- You pay no tax on the capital gains that have accumulated on the securities

- You receive a charitable tax receipt for your donation

Alongside Hope strongly recommends you seek the professional services of a lawyer, accountant or financial advisor to ensure that you consider your financial goals, review your tax situation reviewed and tailor your gift to best fit your circumstances.